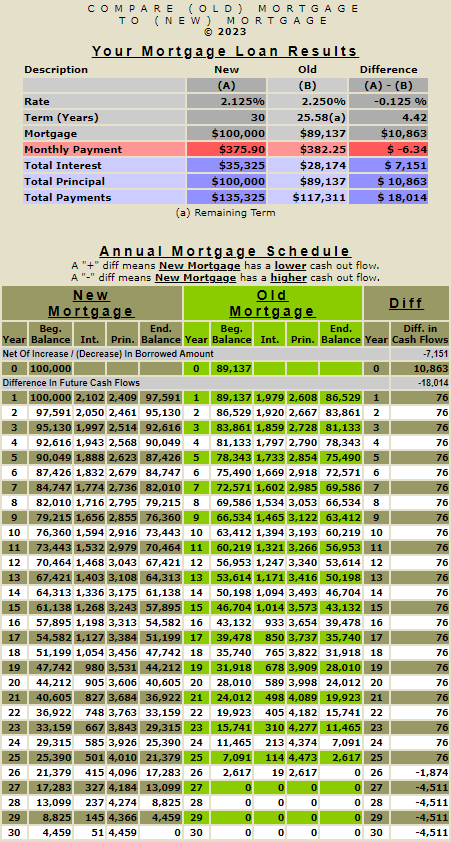

Our mortgage calculators will calculate your monthly mortgage payment or compare two amortizing loans. They will also assist you in determining the benefit of refinancing your loan.

The big question is, "Should I refinance?" The answer is complex. There are both economic and personal reasons to refinance an existing loan. This website focuses on analyzing the economic benefits.

Determining the economic benefits would depend on many factors, i.e.:

- What is the rate on your existing loan?

- What is the current rate at which you can refinance?

- What will it cost you to refinance?

- How long do you expect to hold the property and the loan?

- What is the time value of money?

The calculators on this web site are set up specifically to 1) allow the user the ability to focus on how each of the above factors may affect the potential economic benefit of refinancing an existing loan, and 2) help take the user step by step through the process of understanding the application of these factors. Each calculator will focus on a separate factor at a time. Once the user feels more comfortable, he / she can combine the effects of various elements through the selection of a more advanced calculator, which is designed to provide a comprehensive analysis of all factors.

If you are already an experienced mortgage expert or bond trader, then just select from the menu using the brief descriptions, input the required information, and generate the results. The results will be evident to an experienced individual, and any minute difference between the calculators will quickly become apparent.

If you need to know more, click here to continue reading on the second page.