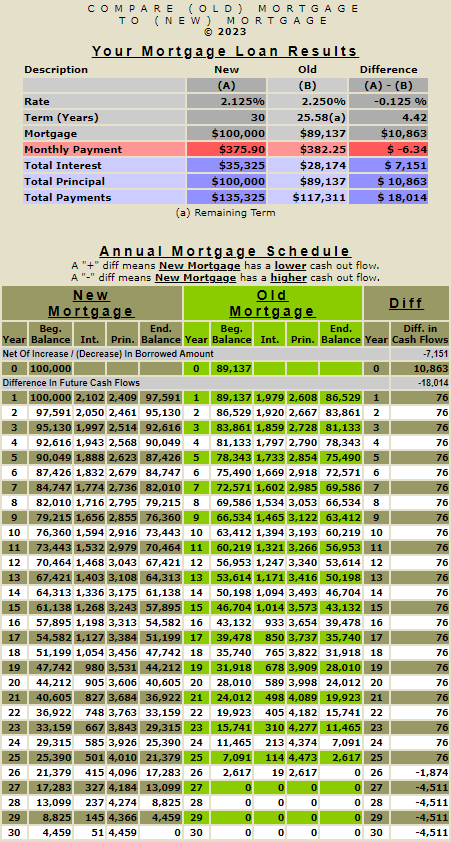

If you have a current mortgage (Old Loan) and are looking to refinance into a new mortgage (New Loan), we need to generate a current amortization schedule for your (Old Loan). Your current loan (Old Loan) has been amortized. For example, the remaining balance will be less than the original balance, so it will fully amortize in a period (starting today) less than its original stated term. A 30-year mortgage you have been paying for three years will finish amortizing in 27 years (30 - 3). By inputting your original mortgage amount, rate, and term, the calculator will determine the payment for your Old Loan. By inputting the remaining balance, the calculator will apply the payment of your Old Loan to your remaining balance and generate a current amortization schedule. This is necessary to compare your current loan with a potential new loan. It is required to show the cash flows from today so that we can compare the cash flows to your new loan.

"Refinance An (Old) Loan To A (New) Loan" Explained

- Details

- Category: Mortgage Calculators Explained