Explanatory Articles

Subcategories

Real Estate Calculators Explained

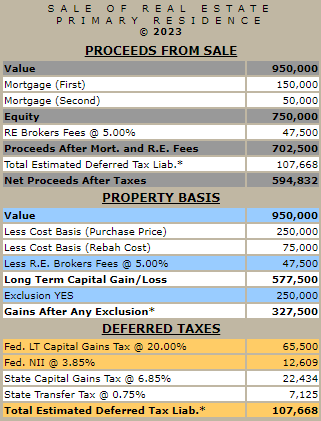

The articles in this category are to help guide you in using the real estate calculators on this website. We offer a variety of calculators, including those for estimating capital gains taxes, calculating net proceeds, and forecasting property appreciation for different set periods. Suppose you want to sell a home, rental, or multifamily property. In that case, you can estimate the federal and state capital gains taxes and calculate the net proceeds after subtracting any loans due, real estate commissions, and other taxes such as state transfer taxes. Below is a list of articles with a brief description.

Calculate Capital Gains Taxes On Sale Of Real Estate

This article will outline the various calculators for specifically selling a home, rental, or multifamily property.

Forecasting Real Estate Property Appreciation

This article will elaborate on performing a forecast of real estate property.

Reverse Mortgage Calculators Explained

The articles in this category are to help guide you in using the reverse mortgage calculators on this website. Articles will discuss the different types of reverse mortgages, compare a reverse amortization schedule to a typical fixed-rate loan amortization schedule, and display how financially a reverse mortgage accretes or grows over time and compare that to an amortizing loan. They will delve into the calculations of a reverse mortgage and show how a home's equity and liquidity are accessed. Below is a list of articles with a brief description.

Mathematically, What is a Reverse Mortgage?

What is a reverse mortgage numerically versus an amortizing mortgage?

Comparing an Amortizing Mortgage to a Reverse Mortgage

How does a reverse mortgage compare to a mortgage that amortizes?

Reverse Mortgages in a Low Interest Rate Environment

How does a lower interest rate environment benefit a reverse mortgage?

Understanding Reverse Mortgages And Liquidity

What are the calculations for accessing a home's equity utilizing a reverse mortgage?

Mortgage Calculators Explained

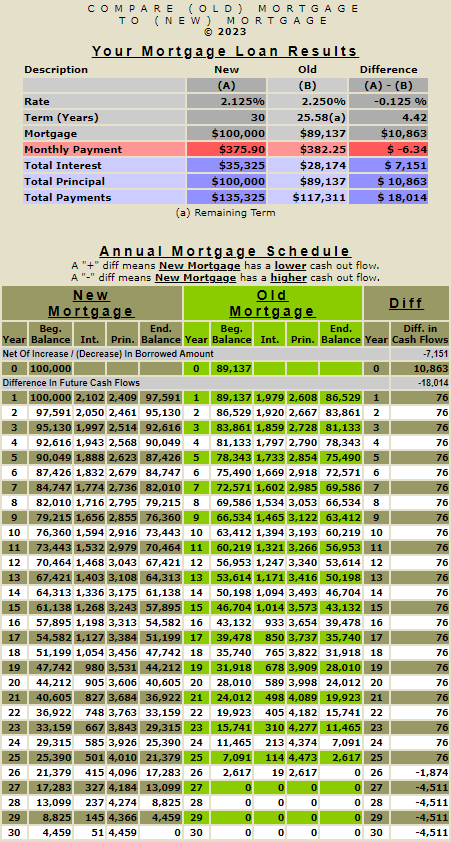

The articles in this category are to help guide you in using the mortgage calculators on this website. They will explain how to compare an existing amortizing loan to a new one, display an amortization schedule for an existing and new one, and sum the total differences in annual cash flows. When comparing two mortgages, you can consider an early payoff due to selling a property before full term or making additional monthly principal payments. Below is a list of articles with a brief description.

Bringing interactive Mortgage Calculators Online.

This article will review the economic variables that play a crucial role in determining to refinance.

A Step By Step Approach To Using These Mortgage Calculators

This article will take a step-by-step approach to looking at mortgage calculators.

"Refinance An (Old) Loan To A (New) Loan" Explained

This article will look at refinancing an existing mortgage.

An Additional Principal Payment Reduces The Term Of A Mortgage.

This article will explain the amortization schedule due to making an additional monthly payment.

Historic Rowhouses

I used to run a website about living in a historic rowhouse in the big city for a short period, Rowhouser.com. Living in the big city is very romantic, especially in a historic rowhouse. I took thousands of photos of historic rowhouses in Jersey City, Hoboken, Manhattan, and Brooklyn to acquaint myself with the history on a romantic level. I have lived in a historic rowhouse with my family for 25 years.

Living In Downtown Jersey City

I attended New York University and have lived in the West Village, Murry Hill, The East Village, Hoboken, and Park Slope. I came to Jersey City in the mid-1990s. Jersey City is unique, with a more toned-down urban environment. Liberty State Park is within walking and biking distance. The train and ferry accessibility to midtown and downtown Manhattan is lovely. Parking is easier. There are many restaurants.