Below is a summary of real estate calculators for the sale of

1) rental property,

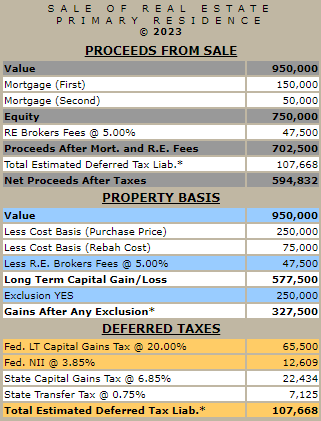

2) owner-occupied residential property, and

3) part rental/part residential real estate property.Here is an excellent place to start before delving into 5, 10, 15, and other multiple forecast calculators. These calculators will estimate the taxes due on the sale of real estate property, including federal and state taxes on any gain, property transfer taxes, and depreciation recapture taxes. Any potential tax exclusion for residential property will be considered when determining taxable gains. Real estate commissions and any outstanding mortgages will be deducted from the proceeds to derive the estimated net proceeds.

This calculator will estimate the federal and state capital gains tax for selling an owner-occupied property.

This calculator will estimate the federal and state capital gains taxes for selling a rental property.

Sale of Part Rental/Party Primary Residence

This calculator will estimate the federal and state capital gains taxes for selling a multi-family property that is owner-occupied and rented.

Here is additional information for estimating the long-term capital gains tax rates and any exclusion for owner-occupied residential property.