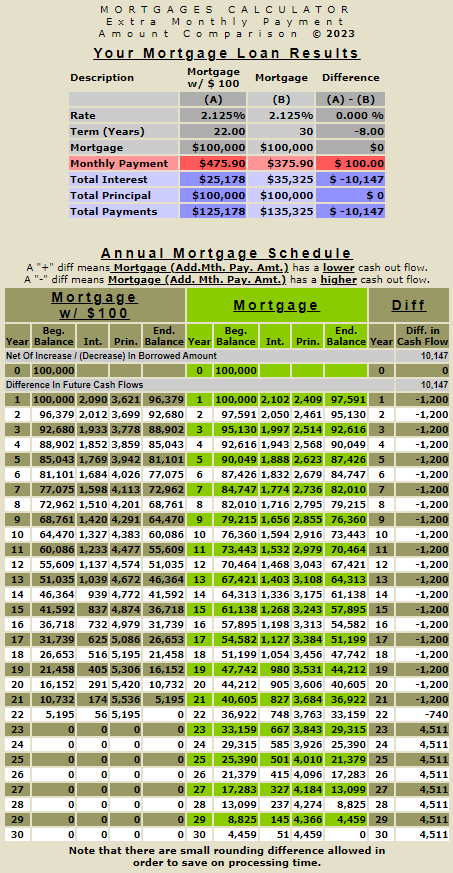

Adding $100 to your monthly mortgage payment will reduce the time it takes to pay off a mortgage. For example, assume a $100,000 mortgage with a fixed rate of 2.125% and a term of 30 years. The required monthly payment is $375.90 (see below example). Adding $100.00 to the monthly payment ($375.90 + $100.00) or $475.90 (see below example) reduces the mortgage term from 30 to 22 years (see below example), and the interest savings over the life of the loan is $10,147 (see below example). In the first 22 years, the annual difference between the amortization schedules is $1,200 because you make an additional monthly payment multiplied by 12 months or ($100 x 12). Try this calculator by clicking here.