In this article, we compare the numeric output of an amortization schedule for an amortizing mortgage to a reverse amortization schedule for a reverse mortgage. The loan balances of these two types of mortgages go in opposite directions. The amortizing mortgage outstanding loan balance amortizes, and the reverse mortgage outstanding loan balance accretes.

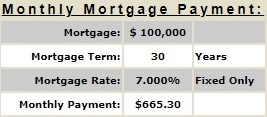

Let's look at refinancing a $100,000 fixed-rate 7% amortizing mortgage into a reverse HECM mortgage with an expected rate of 7%. Immediately below is the monthly payment on a 7% 30-year fixed-rate mortgage, $665.30. Refinancing this loan into a HECM mortgage with an expected rate of 7% will eliminate the need to make monthly mortgage payments on the fixed-rate 7% amortizing mortgage.

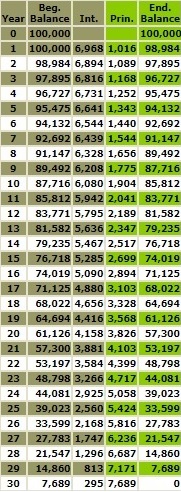

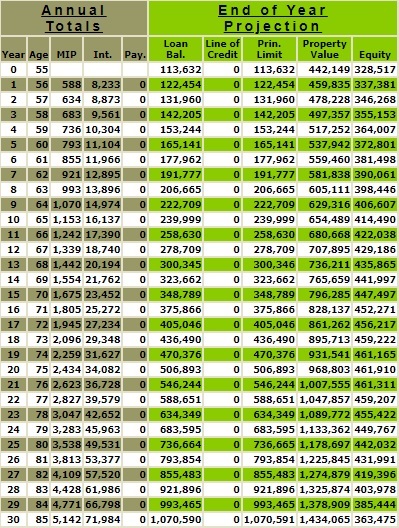

Here is the 30-year amortization schedule for the fixed rate 30-year $100,000 at 7% amortizing mortgage.

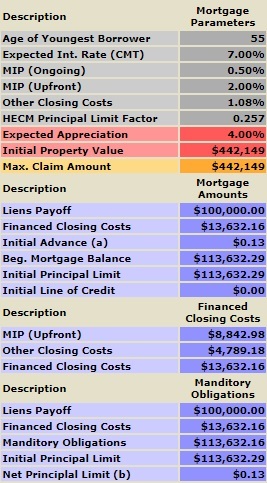

Refinancing the fixed rate 30-year 7% amortizing $100,000 mortgage into a HECM reverse mortgage with an expected rate of 7% will incur an upfront MIP (Mortgage Insurance Premium) cost. This upfront MIP, which is a one-time fee, is calculated based on a home's appraised value up to the maximum claim amount of $1,149,850. The upfront MIP in this example is $ 8,843 or (2% x $442,149). This is in addition to other estimated closing costs of $4,789 (1.08316% x $442,149), resulting in a total of financed closing costs of $13,632 ($8,843 + $4,789).

Hence, on day 1, the original fixed rate amortizing mortgage of $100,000 converted into a HECM reverse mortgage is now $113,632. The upfront MIP of 2% is applied to the home's appraised value unless the appraised value is above the maximum claim amount of $1,149,850. In addition, a HECM reverse mortgage charges an ongoing MIP of .50 percent (50 basis points).

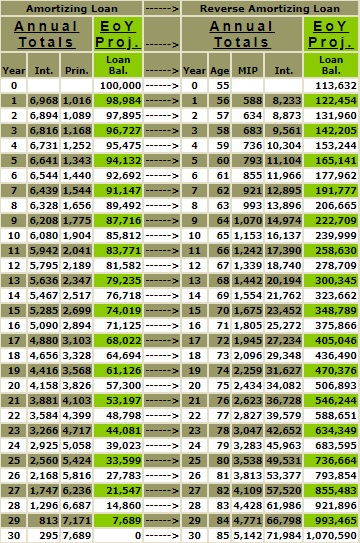

Here, they are side by side below. On the left is the amortization schedule for an amortizing 7% fixed rate mortgage, and on the right is a HECM FHA 7% reverse amortization schedule. As you can see, the starting balance of the 7% fixed rate amortizing mortgage is $100,000, and the starting balance for the HECM FHA 7% reverse amortizing mortgage is $113,632 ($100,000 plus closing costs of $13,632). The interest and the ongoing MIP are added to the HECM FHA mortgage annually, and the outstanding balance grows. By the end of 30 years, the 7% fixed rate amortizing mortgage is 0, and the balance of the HECM FHA 7% reverse amortizing mortgage is $1,070,590.

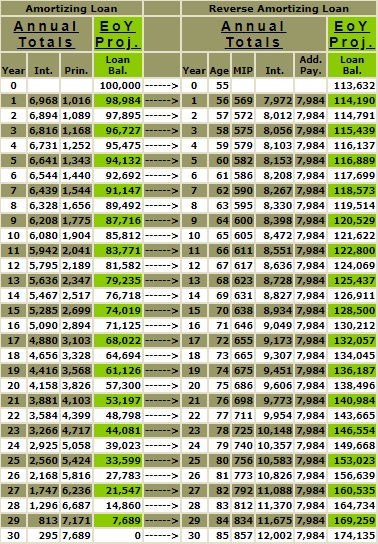

This comparison of the amortization schedule for the 7% fixed rate 30-year mortgage and the HECM FHA 7% reverse mortgage vividly illustrates the compounding effect of money. Both these loans, despite having the same interest rate, lead in different monetary directions. The 7% fixed rate mortgage follows a traditional path of monthly payments, while the HECM FHA reverse mortgage offers the unique benefit of being able to forego making monthly mortgage payments. But for comparative purposes, let’s examine what might happen if we paid the monthly $665.30 payment required on the 7% fixed rate amortizing mortgage towards the HECM FHA reverse mortgage. This monthly payment would equal annual payments of $7,983.60 or ($665.30 x 12 months).

By the end of 30 years, the 7% fixed rate amortizing mortgage is 0, and the balance of the HECM FHA 7% reverse mortgage is $174,135. The $174,135 reflects the compounding effects in the difference in the starting balances of the two mortgages $13,632 ($113,632 - $100,000) and the additional .50% ongoing MIP. I have approached the above example segmentally to isolate the various mathematical impacts.

So, what are the numerical benefits of getting a reverse mortgage over a typical amortizing mortgage? The answer is liquidity, and it is essential to note that these ending differences in the outstanding balances of these two types of mortgages. will be narrower in a lower interest rate environment. Continue to the next page for further discussion.