This article will examine the effects of interest rate levels and their accumulative effect on a reverse mortgage over time.

In the previous article, "Comparing an Amortizing Mortgage to a Reverse Mortgage," we viewed the effects of the compounding of money. We compared the numeric differences between an amortizing mortgage versus a reverse amortizing mortgage utilizing a 7% fixed rate and a 7% expected rate, and both these mortgage balances went in different directions. For instance, we found that after 30 years, the amortizing mortgage had reduced the principal by [100%], while the reverse amortizing mortgage had increased the principal by [842%]. The differences were somewhat shocking, and ultimately, one might question the utility of a reverse mortgage. The answer is in the additional liquidity a reverse mortgage provides and the increased advantages of reverse mortgages in a low-interest rate environment.

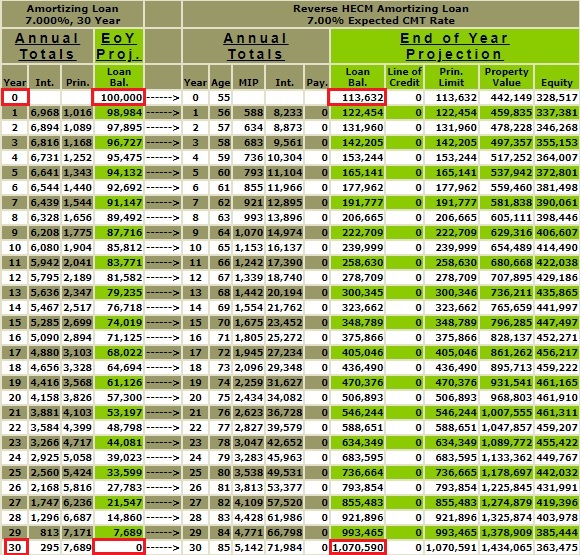

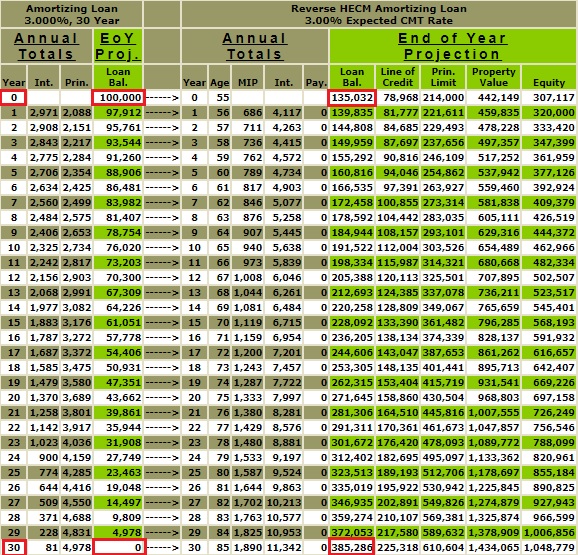

In the previous article, we compared a 30-year 7% fixed rate amortizing mortgage to an HECM FHA reverse mortgage with an expected rate of 7%. As a recap, see the below table. Refinancing the fixed rate 30-year 7% amortizing $100,000 mortgage into a HECM reverse mortgage with an expected rate of 7% will cost $8,843 in upfront MIP plus other estimated closing costs of $4,789 for a total of financed closing costs of $13,632. Hence, on day 1, the original mortgage of $100,000 is now $113,632.

The starting balance of the 7% fixed rate amortizing mortgage is $100,000, and the starting balance for the HECM FHA 7% reverse mortgage is $113,632 ($100,000 plus closing costs of $13,632). The interest and the ongoing MIP are added to the HECM FHA mortgage annually, and the outstanding balance grows. By the end of 30 years, the 7% fixed rate amortizing mortgage is 0, and the balance of the HECM FHA 7% reverse mortgage is $1,070,590.

Before we delve into the liquidity benefits of a reverse mortgage, let's explore the potential benefits of a lower interest rate environment. This shift to a lower interest rate environment could significantly impact the financial results. Below is a comparison of similar circumstances, except now, mortgage rates are not 7% but a hypothetical 3%. Remember, reverse mortgages accrete; a higher interest rate will only exemplify the compounding effect on a reverse mortgage's outstanding loan balance over time or vice versa. In the example below, the compounding impacts diminish due to a lower rate of 3%, but the opposite effect would result if the interest rate increased. These analyses assume a constant interest rate over the life of the mortgage. If a mortgage has an adjustable interest rate, then over time, the results would be subject to future changes in interest rates.

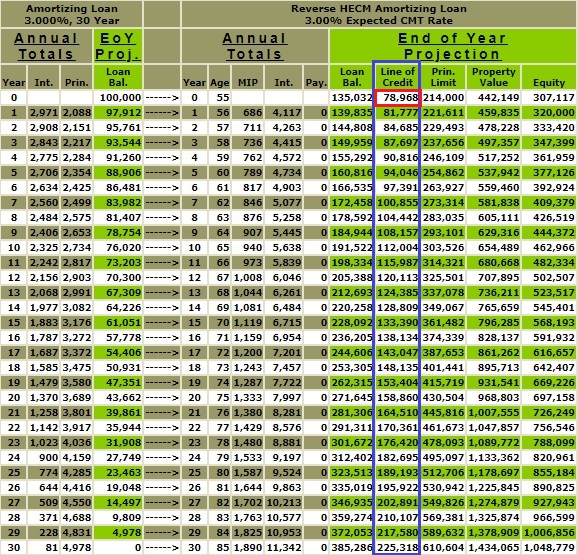

In the above table, the reverse mortgage with an expected rate of 3% ended year 30 with a loan balance of $385,286, whereas in our previous example, our reverse mortgage with an expected rate of 7% ended year 30 with a loan balance of $1,070,590.

The starting balance on the HECM FHA mortgage with an expected rate of 3% differs from the previous example of 7% because, in this instance, the borrower is due to receive an "initial cash advance" of $21,400 at closing due to a change in the "principal limit factor." The "initial cash advance" is determined by multiplying the "principal limit factor" by the "initial property value" multiplied by 10%. The "principal limit factor" is based on the "age of the youngest borrower" and the "expected rate." The "initial cash advance" of $21,400 must be added to the opening balance of $113,632. The starting balance represents $100,000 plus the financed closing costs of $13,632 plus the "initial cash advance" of $21,400 for $135,023. I will delve into the "initial cash advance" and the "initial principal factor" in a subsequent article. For now, I am trying to isolate the compounding effects of money on the outstanding balance based on different interest rates.

In addition, by the end of 30 years, the 3% fixed-rate amortizing mortgage will be 0. The balance of the HECM FHA 3% reverse mortgage is now $385,286, including the initial cash advance of $21,400 and any interest and ongoing MIP on this amount. Though we are attempting to focus on the impact of the interest rate environment on reverse mortgages, the initial cash advance has more to do with liquidity. Still, as I previously mentioned, I will address this in a subsequent article.

Now, we can begin to discuss the liquidity benefits, but in doing so, we first need to understand the "principal limit factor" and how it might impact our analysis.