The current article will delve into the liquidity benefits of a reverse mortgage, but to do so, we need to understand how liquidity is tapped from a home's equity by the owner utilizing a reverse mortgage. We need to understand the calculations to know how much equity a HECM reverse mortgage can provide. Please read the previous three articles on reverse mortgages before delving into this section on liquidity. Here is a list:

Mathematically, What is a Reverse Mortgage?

This article gives a brief numeric description of a reverse mortgage versus an amortizing mortgage.

Comparing an Amortizing Mortgage to a Reverse Mortgage

This article compares the amortization schedule of an amortizing mortgage to a reverse amortization schedule of a reverse mortgage.

Reverse Mortgages in a Low Interest Rate Environment

This article highlights the effects of interest rate levels on the economics of a reverse mortgage versus an amortizing mortgage.

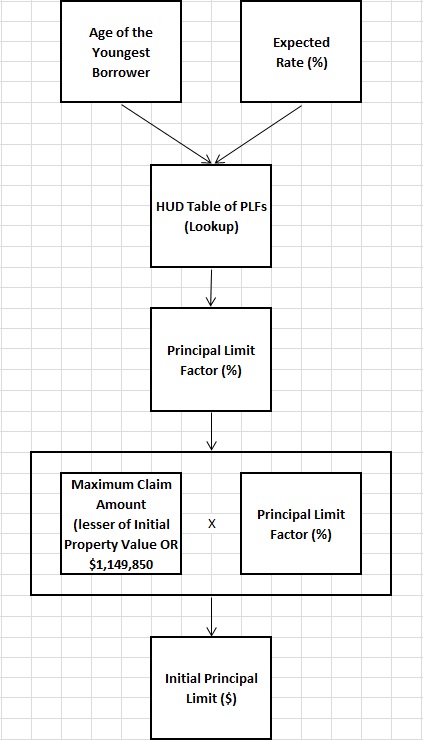

Let's discuss the "principal limit factor" and the "initial principal limit," two variables used to determine a home's equity accessibility via a HECM reverse mortgage.

The "principal limit factor" is used in determining the "initial principal limit," which further drives the "initial cash advance" and the available "line of credit."

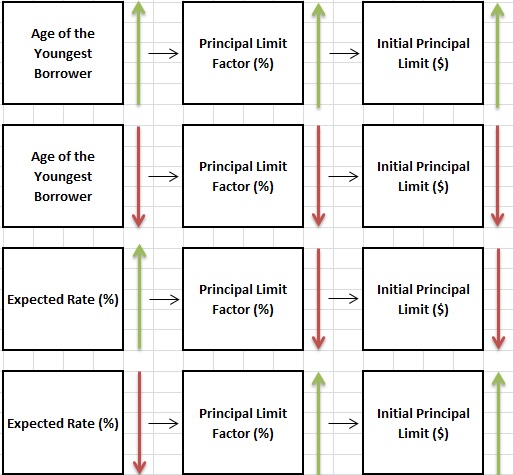

The "principal limit factor" is based on the "age of the youngest borrower" and the "expected rate." The "age of the youngest borrower" and the "expected rate" are used to obtain the "principal limit factor" from a table with HUD.

The "initial principal limit" is based on the "principal limit factor" multiplied by the "maximum claim amount." The "maximum claim amount." is the lesser of the "initial property value" or $1,149,850. $1,149,850 is the maximum claim amount available for a HECM FHA reverse mortgage.

In the previous article there was an "initial cash advance" of $21,400 in our 2nd example forwarded to the borrower at closing. In addition, there is a growing "line of credit", $78,968, at the end of year 1.

The reason for the "initial cash advance" and the "line of credit" is the change in the "principal limit factor" resulting from a shift in the "expected rate" on the HECM reverse mortgage from 7% to 3%.

The "principal limit factor" for "age of the youngest borrower" of 55 and the "expected rate" of 3% is .484.

The "principal limit factor" for "age of the youngest borrower" of 55 and the "expected rate" of 7% is .257.

The "initial principal limit" for a property value of $442,149 and a "principal limit factor" of .484 is $214,000 ($442,149 x .484).

The "initial principal limit" for a property value of $442,149 and a "principal limit factor" of .257 is $113,632 ($442,149 x .257).

Here is a flow chart depicting the relationship between "age of the youngest borrower" and "expected rate" with the "principal limit factor" which drives the "initial principal limit".

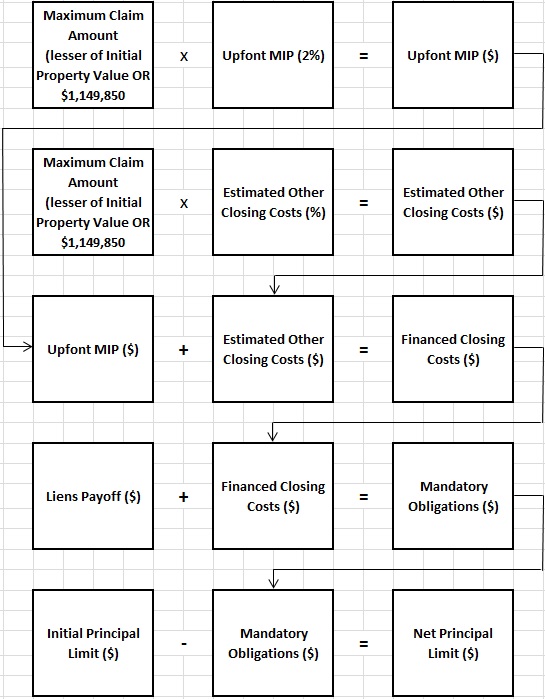

Now we need to calculate the "net principal limit". The "net principal limit" is the "initial principal limit" less any "mandatory obligations." The "mandatory obligations" would be any existing liens, the upfront MIP, and the other closing costs. Below is a flow chart showing how the "net principal limit" is derived.

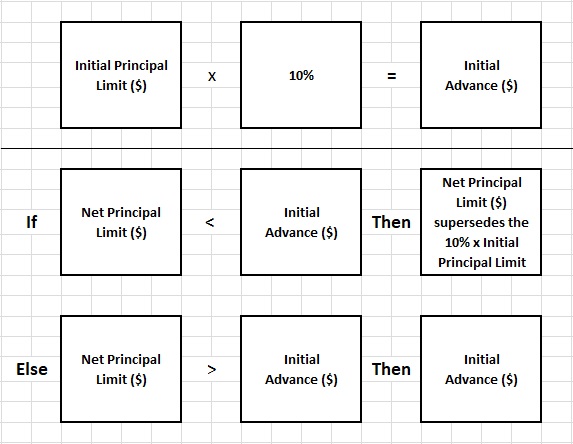

Now, we need to calculate the "initial advance." The "initial advance" is typically 10% of the "initial principal limit" unless the "net principal limit" is insufficient to allow for the total amount. If the "net principal limit" is less than the "initial advance," the "net principal limit" will supersede the "initial advance" ("initial principal limit" multiplied by 10%), and the "net principal limit" will become the "initial advance." If the "net principal limit" is not only below the "initial advance" but is negative, then the loan is considered "short to close."

In our original analysis, I set the property appraised value to $442,149, the age of the youngest borrower to 55, and the expected interest rate to 7% so that the "principal limit factor" resulted in a 0 "initial cash advance" and a "loan balance" equal to the "principal limit" so that the "line of credit" would be 0 throughout the life of the mortgage. The "line of credit" is the difference between the "principal limit" and the "loan amount."

In Summary:

The "net principal limit" will determine the net available liquidity that can be accessed utilizing a reverse mortgage.

Use the below to determine the "principal limit factor" from the HUD tables.

- "age of the youngest borrower"

- "expected rate"

Take the "principal limit factor" multiplied by the "maximum claim amount." (derived from the lessor of the "initial property value" or $1,149,850) to determine the below:

- "initial principal limit"

Subtract the "mandatory obligations" (upfront MIP, other closing costs, and outstanding liens) from the "initial principal limit" to determine the below:

- "net principal limit"

If the "net principal limit" is above the "initial advance," there is liquidity. If it is below the "initial advance" but still positive, there is some liquidity. If it is negative, the loan is "short to close," and there is no additional liquidity.

Note: If you want to run some calculations by changing the input, try this calculator, HECM Reverse Mortgage LOC Calculator. This calculator will automatically obtain the "principal limit factor" based on the "age of the youngest borrower" and the "expected rate." It will run all the calculations based on the required input, "age of the youngest borrower," "expected rate," "initial property value," and "liens payoff." It is best not to change the input for "MIP (Upfront Mortgage Ins.)" = 2%, "MIP (Ongoing Mortgage Ins.)" = .50%, and "Expected Appreciation" = 4%. These are relatively fixed.