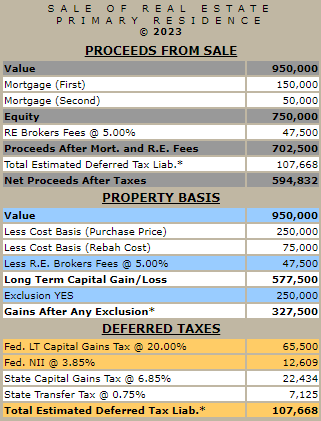

Calculate the taxes paid on sale of primary residence.

This real estate calculator will estimate the federal and state taxes after applying the capital gains exclusion and estimate the net proceeds from a hypothetical sale of a primary residence.

To establish a basis for the property, you would need to input your purchase price and any documented improvements (rehab costs). Then, enter the current price (hypothetical selling price).

Enter what you owe on a first mortgage and second mortgage.

Understanding your federal capital gains tax rate is critical. If you held the asset for one year or less, you would use your federal ordinary income tax rate. If you have held the property for over a year, you will use a federal long-term capital gains rate. This knowledge directly impacts your tax liability and net proceeds from a home sale.

You must determine if you are eligible for a capital gains exclusion, a tax benefit that excludes a certain amount of your profit from your taxable income. Typically, you would qualify for a capital gains tax exclusion if you maintained the property as your primary residence for at least two years. The exclusion amount is $250,000 for a single individual and $500,000 for a married couple filing jointly. There maybe extenuating circumstances, so it is advisable to review the tax code.

Enter the real estate commission as a percentage. The real estate commissions will be deducted from the equity, which is the difference between the property's market value and the amount you owe on any mortgages, to determine the net proceeds.

If you want to include additional taxes like Transfer Tax, a tax on the transfer of real property, and NII (Net Investment Income) tax, a tax on certain investment income, click the small hyperlink near the bottom of the input screen. These taxes can significantly impact your overall tax liability, so it's essential to consider them in your planning.

The results will display three sections: Proceeds From Sale, Property Basis, and Deferred Taxes. The middle section (Property Basis) calculates the estimated Gains After Any Exclusion. The third section (Deferred Taxes) takes the Gains After Any Exclusion and applies the various tax rates to determine a Total Estimated Deferred Tax Liability. The first section determines an estimated Net Proceeds After Taxes. The calculations are performed in the above sequence.