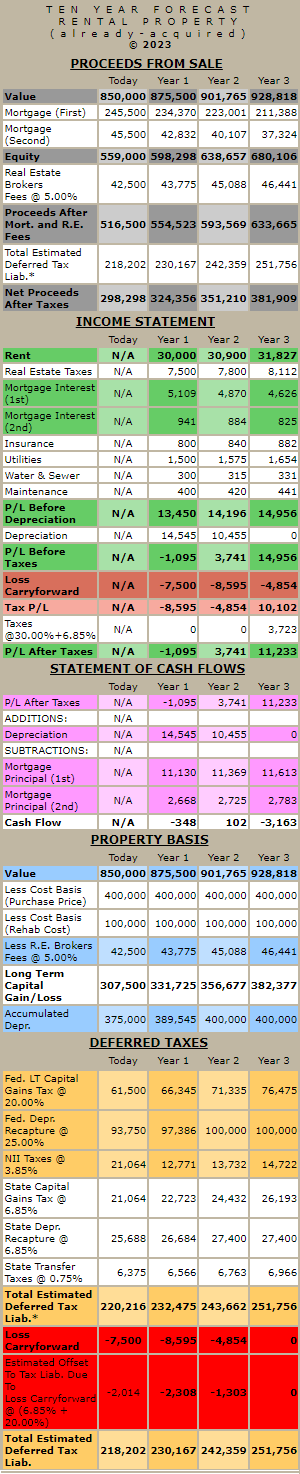

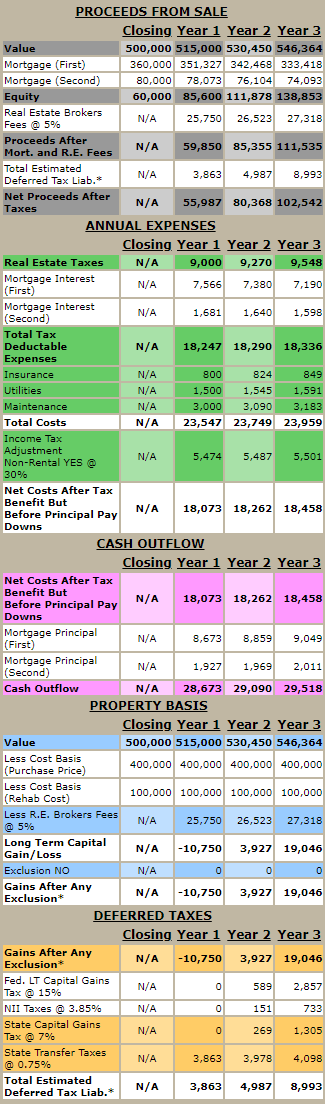

Evaluate The NPV Of A Rental Property.

This real estate calculator takes a detailed approach to calculating the net present value of a real estate investment forecast over twenty years. It considers the NPV of the investment if it is liquidated in any year, based on the NPV of the cash flows. These cash flows are determined by the cost of funds measured in interest rates. The initial cash outflow, representing a down payment, and the inflows, representing net rental income, are all factored in. The remainder of the investment is assumed to be funded by borrowed funds. The net proceeds at the time of sale of the investment are also discounted to present value. The net of all the discounted cash flows would result in the forecasted NPV of the investment.