Real Estate Calculators - Part Rental Property / Part Primary Residence

This category of real estate calculators will estimate taxes on the sale of a primary residence / rental property, perform a forecast of 5, 10, and 15 years, and consolidate the results.

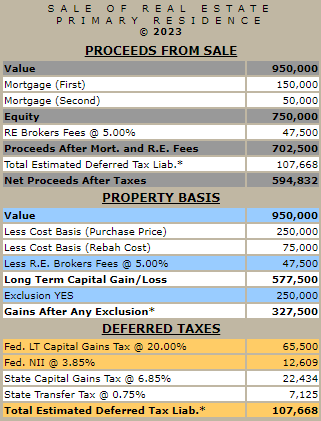

Calculate the taxes paid on sale of part owner occupied / part rental property.

This real estate calculator will estimate the federal and state taxes and estimate the net proceeds from a hypothetical sale of a part primary residence / part rental property.

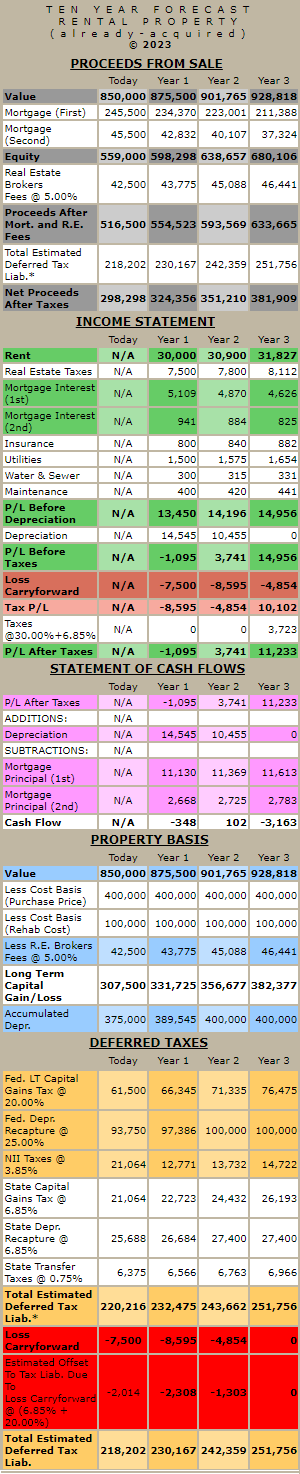

1 year forecast of (part primary residence / part rental) property with expenses.

This real estate calculator will perform a 1-year forecast of a part primary residence/part rental property. It calculates net proceeds on a sale after deducting taxes and real estate commissions, separating the tax implications for the owner-occupied portion from the rented. This calculator is ideal for a multifamily property in which the owner occupies part of the property and leases part of the property. It subsequently consolidates the above two circumstances. It includes a projection of property expenses, allowing you to observe how over one year of renting out a portion of your primary residence may impact your cash flows.

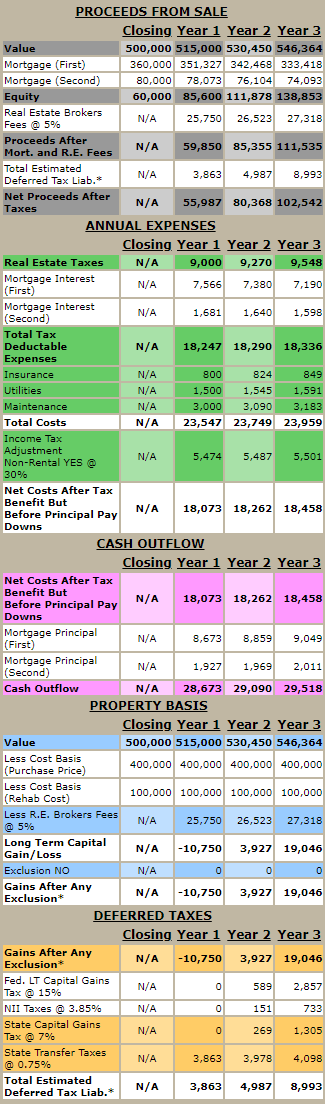

5 year forecast of (part primary residence / part rental) property you already own.

This real estate calculator will perform a 5-year forecast of a (not-yet-acquired) part primary residence/part rental property. It forecasts appreciation of the property's value and net proceeds after deducting taxes and real estate commissions each year on a future sale. It separates the tax implications for the portion of the owner-occupied percentage of the property and the portion of the rented property. This calculator is ideal for a multifamily property in which the owner occupies part of the property and leases part of the property. It subsequently consolidates the taxes and net proceeds.