The primary residence capital gains tax exclusion for homeowners, as defined under Section 121 of the Internal Revenue Code, is currently set at $250,000 for single filers and $500,000 for married couples filing jointly. This amount has remained unchanged since its introduction in 1997. The No Tax on Home Sale initiative seeks to address the concern that there should be no capital gains tax on the sale of a primary residence. At the very least, it argues that the exclusion amounts of $250,000 and $500,000 should be adjusted for inflation.

I do not believe that the capital gains tax on primary residences will be eliminated, as such a change would primarily benefit the ultra-wealthy. For example, if someone bought a primary residence for $5,000,000 and later sold it for $20,000,000, they would realize a gain of $15,000,000 (the difference between $20,000,000 and $5,000,000). If the capital gains tax were eliminated on home sales, there would be no tax on that $15,000,000 gain. However, I believe the existing exclusion amounts of $250,000 for individuals and $500,000 for couples might be adjusted to $500,000 and $1,000,000, respectively.

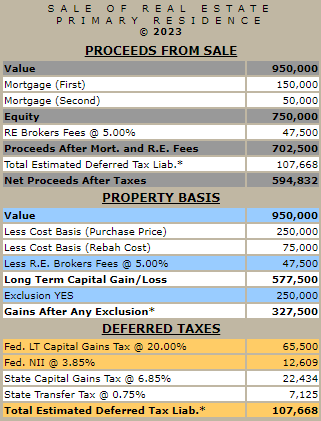

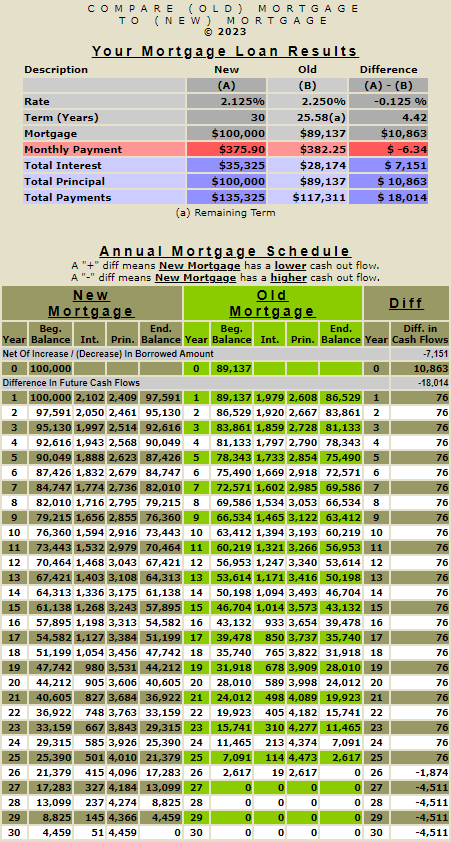

Try my calculator to estimate the impact of a possible change in IRS Code 121, which would increase the exclusion amounts from $250,000 for individuals and $500,000 for couples to $500,000 and $1,000,000, respectively. Click the link below to try it out.

One reason to adjust the exclusion amounts from $250,000 for single filers and $500,000 for married couples filing jointly to account for inflation is that it would encourage more potential homeowners to sell their homes. Many homeowners currently have gains that exceed these exclusion limits, which could lead to capital gains taxes. By increasing the exclusion amounts, more homeowners would be motivated to sell without the burden of extra taxes, ultimately freeing up more homes for sale.

I find myself facing a similar dilemma. If I sell my home and choose to downsize, I would still have to pay federal and state taxes, even after the exclusion. I live in the New York metropolitan area and have been in my home for around 30 years.

If I were to move to another state where housing prices are significantly lower than those in the New York metro area, it might make financial sense to sell and pay the taxes. However, since I have family in the area, downsizing to a home nearby would likely negate most of the financial benefits due to the tax liability and transaction costs.

The couple featured in the article titled "A Boomer Couple Wants to Sell Their 5-Bedroom Home, But They're Delaying in Hopes of Avoiding at Least $700,000 in Taxes" is seeking to eliminate capital gains taxes on their primary residence. If the exclusion amounts were adjusted for inflation, I would consider selling my home and downsizing, even though I might still have to pay some capital gains taxes. An adjustment to the exclusion amounts would be enough to encourage me to sell and downsize, even without the complete elimination of capital gains taxes.

At present, there is no indication of when or if any changes might take effect.

Here is a list of sources, articles, and related links. I will continue to add to it as I discover more informative resources.

1. "Congresswoman Marjorie Taylor Greene Introduces Bill to Eliminate Capital Gains Tax on Home Sales"

2. "H.R.4327 - No Tax on Home Sales Act"

3. "The Exclusion of Capital Gains for Owner-Occupied Housing"

4. "Momentum Builds for Capital Gains Reform for Home Sales"

5. "Trump floats ‘no tax on capital gains’ for home sales. Here’s who could benefit"