Real Estate Calculators Explained

- Details

- Category: Real Estate Calculators Explained

Our real estate calculators offer a comprehensive forecast for rental property revenues, expenses, and cash flows. They provide a detailed 10-year projection of rents, expenses, depreciation, and cash flows.

These calculators are not just about forecasting real estate appreciation, they also include an income statement and a statement of cash flows. The income statement projects rental income and expenses, deducting depreciation (a non-cash flow income statement line item). Mortgage payments are carefully considered, including only interest expense, as the principal portion of the annual fees is not an income statement expense.

The statement of cash flows is equally comprehensive, adding back depreciation as an expense but not a cash flow item. Annual principal payments on any mortgage are deducted from the statement of cash flows.

Below is a summary of real estate calculators for forecasting real estate rental property revenues, expenses, and cash flows.

Advanced Rental Property Forecast (not-yet-acquired)

Advanced Rental Property Forecast (already-acquired)

- Details

- Category: Real Estate Calculators Explained

Below is a summary of real estate calculators for forecasting real estate appreciation based on the following types.

1) rental property,

2) owner-occupied residential property, and

3) part rental/part residential real estate property.

Below, you can generate an estimated forecast of appreciation of a property. It's crucial to enter your basic mortgage information accurately, as this directly impacts the accuracy of the forecast. Most mortgages amortize over a specific number of years, and the outstanding balance will decline over the period specified. Choose between rental property, owner-occupied property, and part rental/part residential real estate property. Part rental/part residential real estate property is commonly multifamily property that is owner-occupied and rented. Choose between (not-yet-acquired) vs. (already-acquired).

Forecast the real estate appreciation of a rental property.

Forecast (Rental) Property (not-yet-acquired)

Forecast (Rental) Property (already-acquired)

Forecast the real estate appreciation of a owner-occupied residential property.

Forecast (Primary Residence) Property (not-yet-acquired)

Forecast (Primary Residence) Property (already-acquired)

Forecast the real estate appreciation of a part rental/residential real estate property. This calculator will separate the rental and owner-occupied portions by percentage and then consolidate them.

Forecast (Part Primary Residence / Part Rental) Property

The above real estate calculators only forecast the balance sheet, which is a financial statement that shows a property's assets, liabilities, and equity over a specific period in time. This does not include rental income, which is the revenue generated from leasing a property. The advanced and NPV real estate calculators will include rental income and expenses in their projections but require additional input.

- Details

- Category: Real Estate Calculators Explained

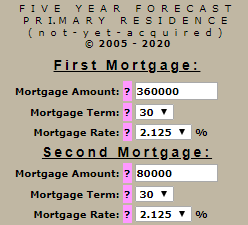

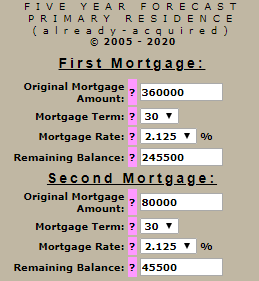

What is the difference between (not-yet-acquired) vs. (already-acquired), and why are these presented this way?

(not-yet-acquired) is a property that you anticipate purchasing or that you are considering buying.

(already-acquired) is a property that you have been utilizing for a period of time, and hence you already own it.

There are several reasons why I separate these circumstances into two separate calculators for forecast-type calculators. One of the obvious reasons should become apparent by comparing the two "Input Your Variables" pages (see below examples). The input information requested for mortgage information for (already-acquired) requires one additional input variable, "Remaining Balance."

In the case of (already-acquired), your mortgage has already been amortizing since you purchased the property, and the balance currently due on your mortgage today does NOT equal its original balance. Therefore, I required the initial balance and original mortgage terms to calculate the monthly payment so that I can apply your monthly payment amount in amortizing any remaining balance and thus create an accurate forecast from "Today"!

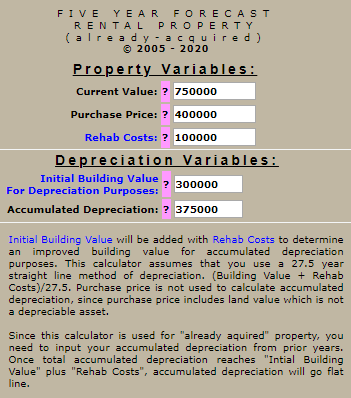

For rental property, I need to separate "not-yet-acquired" from "already acquired" for the above reasons concerning loan amortization and make certain adjustments for accumulated depreciation.

Rental property that is "not-yet-acquired" can begin the depreciation process "Today" without concern for any prior years' depreciation, simply because "property that has not yet been acquired" would have no prior year's depreciation.

Rental property "already acquired" has already started the depreciation process in prior years. Hence, you need to input any prior year's accumulated depreciation so that it can be added to future estimated depreciation and thus create an accurate forecast from "Today"!

- Details

- Category: Real Estate Calculators Explained

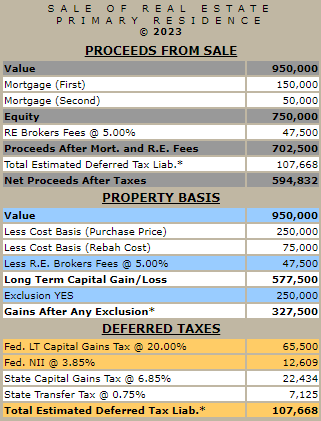

Below is a summary of real estate calculators for the sale of

1) rental property,

2) owner-occupied residential property, and

3) part rental/part residential real estate property.Here is an excellent place to start before delving into 5, 10, 15, and other multiple forecast calculators. These calculators will estimate the taxes due on the sale of real estate property, including federal and state taxes on any gain, property transfer taxes, and depreciation recapture taxes. Any potential tax exclusion for residential property will be considered when determining taxable gains. Real estate commissions and any outstanding mortgages will be deducted from the proceeds to derive the estimated net proceeds.

This calculator will estimate the federal and state capital gains tax for selling an owner-occupied property.

This calculator will estimate the federal and state capital gains taxes for selling a rental property.

Sale of Part Rental/Party Primary Residence

This calculator will estimate the federal and state capital gains taxes for selling a multi-family property that is owner-occupied and rented.

Here is additional information for estimating the long-term capital gains tax rates and any exclusion for owner-occupied residential property.